Develop An ARIMA Model With Python

Mojave Desert, CA. Some rights reserved.

This blog shows the steps I take to create the ARIMA model for times series forecasting and how I use Python to implement it with an example.

- Check the characteristics of data

- Find and evaluate the possible models

- Method 1: manual parameter selection

- Method 2: automatic parameter selection

- Choose the better model

- Other things to consider

Check the characteristics of data

Dataset

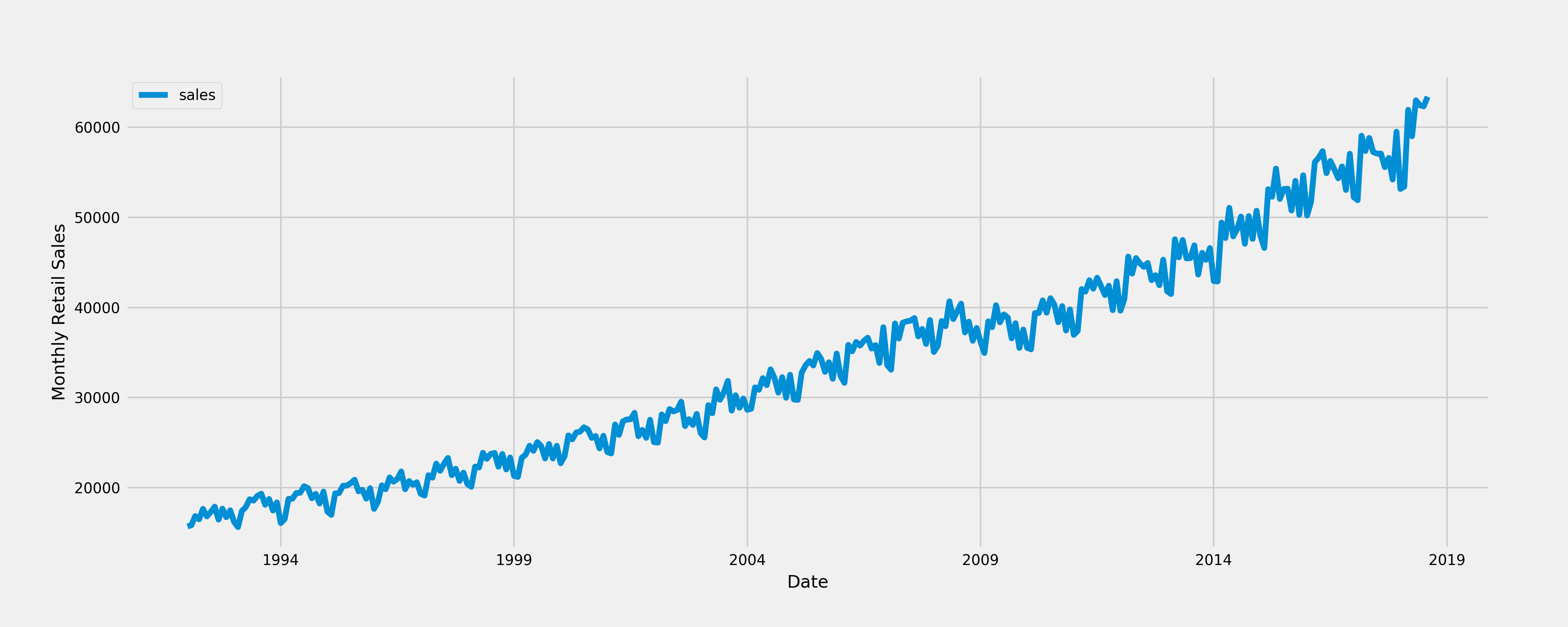

The dataset I use to create the ARIMA model describes the monthly retail sales for food services and drinking places in the United States from years 1992 to 2018. You can download this dataset here.

Process data

First import packages.

import pandas as pd

import numpy as np

import statsmodels.api as sm

from statsmodels.graphics.tsaplots import plot_acf, plot_pacf

import matplotlib.pyplot as plt

plt.style.use('fivethirtyeight')

%matplotlib inline

Then load and process the data.

data = pd.read_csv("retail_sales.csv")

# convert column DATE to datetime type

data['DATE'] = pd.DatetimeIndex(data['DATE'])

# rename columns

data.columns = ['month', 'sales']

data.head()

Show the first 5 rows of the dataset as below.

| month | sales | |

|---|---|---|

| 0 | 1992-01-01 | 15693 |

| 1 | 1992-02-01 | 15835 |

| 2 | 1992-03-01 | 16848 |

| 3 | 1992-04-01 | 16494 |

| 4 | 1992-05-01 | 17648 |

The data can be plotted as a time series.

Now we are able to observe the important characteristics of data:

- Trend: there is an upward trend.

- Seasonality: there is a regularly repeating pattern of highs and lows related to certain time of the year. A seasonal difference might be considered.

- Outliers: There is no obvious outliers.

- Variation: It looks like there is increasing variation over time but it is not certain.

For different scenarios,

- If there is seasonality and no trend, then take a difference of lag S.

- If there is linear trend and no obvious seasonality, then take a first difference. A quadratic trend might need a 2nd order difference.

- If there is both trend and seasonality, apply a seasonal difference to the data and then re-evaluate the trend.

Find and evaluate the possible models

Method1 - Manual parameter selection

Differencing

The stationary series is needed when fitting an ARIMA model. If the time series is not stationary, it needs to be so through differencing.

A stationary time series is one whose statistical properties such as mean, variance, autocorrelation, etc. are all constant over time.

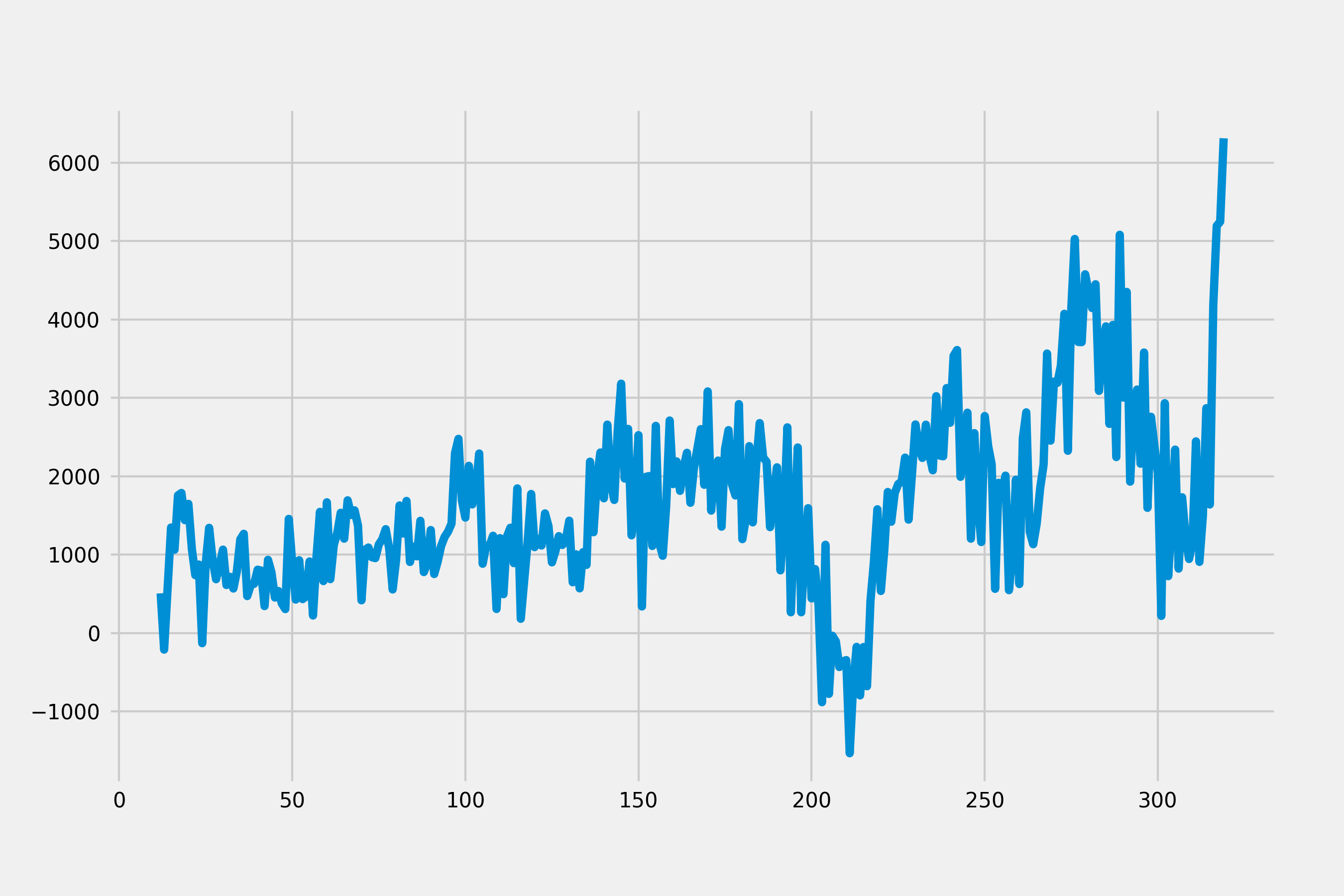

Because there is an obvious upward trend with seasonality. We may need to apply a seasonal difference first.

diff = data['sales'].diff(12)

diff = diff.dropna()

diff.plot()

plt.show()

Because trend seems still increasing and the mean of this series varies across different time windows, we could add a non-seasonal difference and check the plot again.

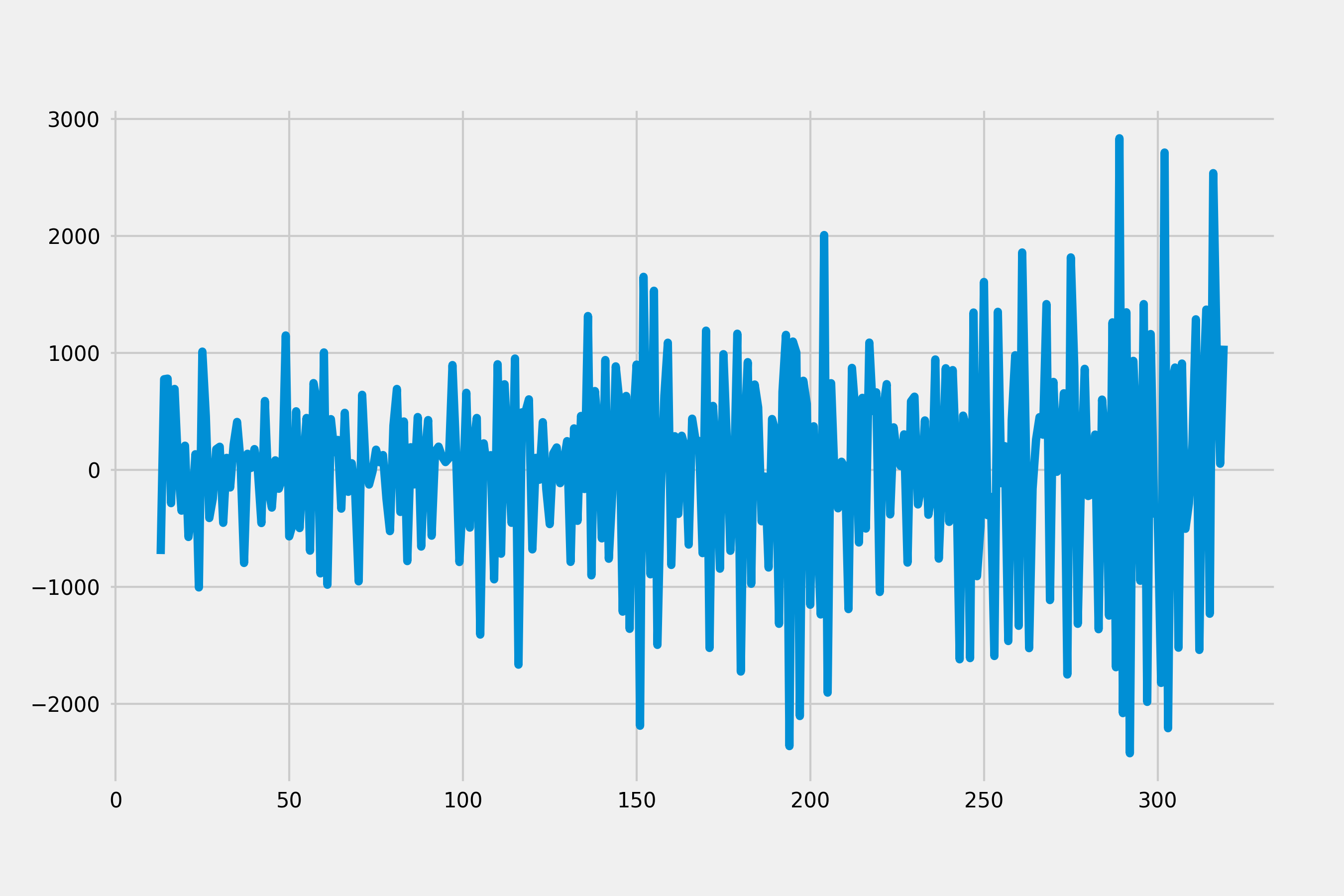

diff = diff.diff(1)

diff = diff.dropna()

diff.plot()

plt.show()

This plot shows a stable series since data values oscillate with a steady variance around the mean of 0. Statistical tests like Dickey-Fuller test can be used to test stationarity of time series.

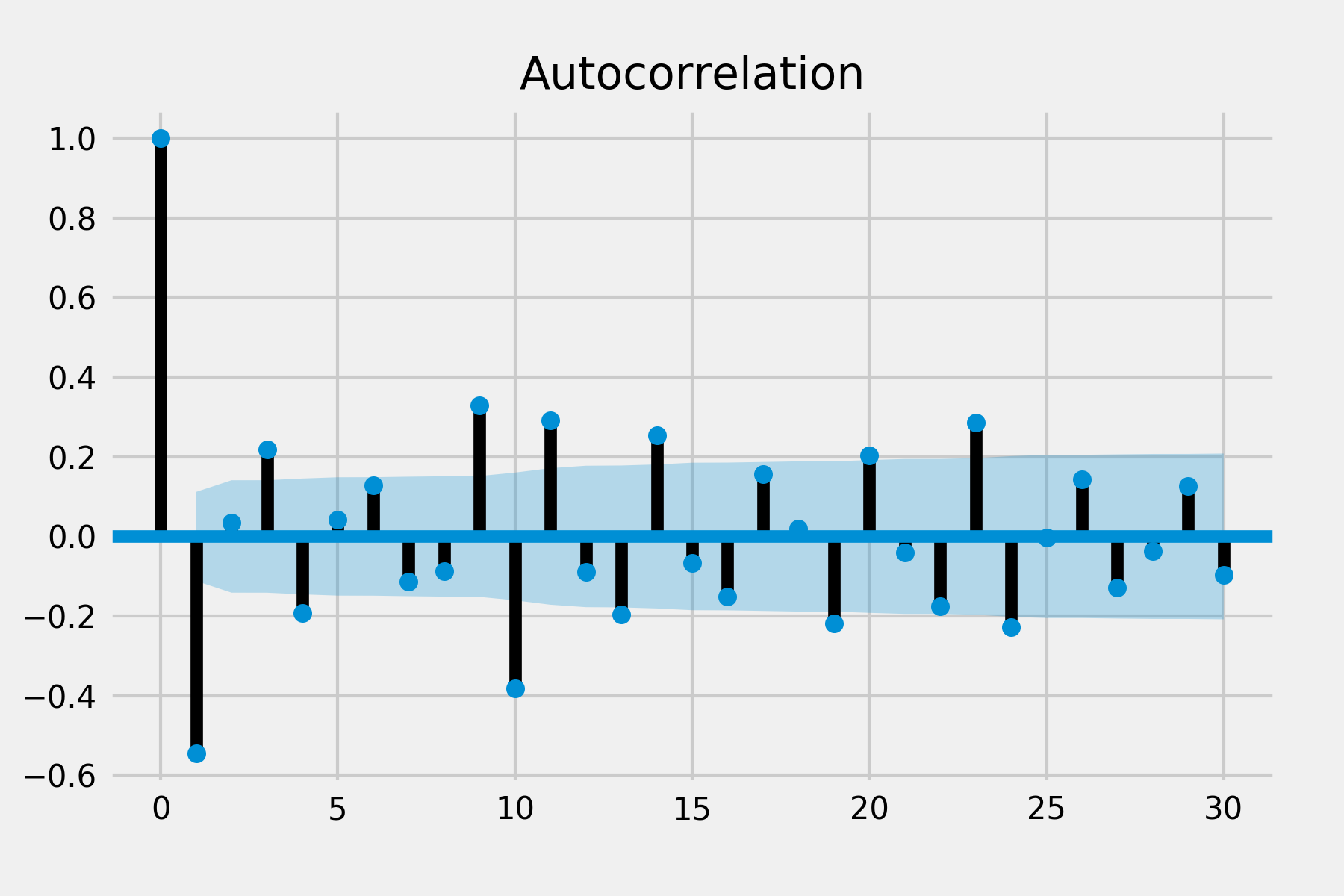

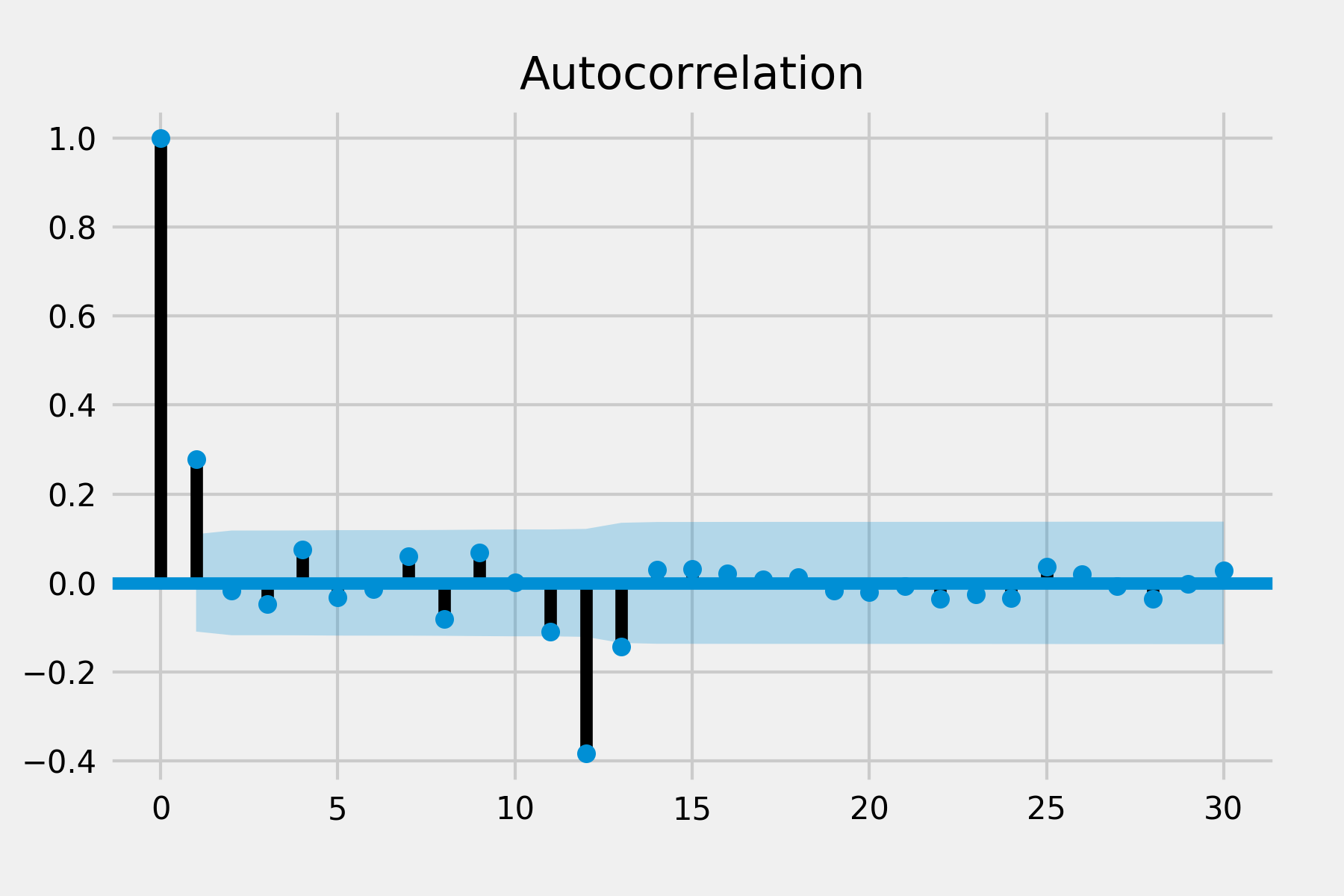

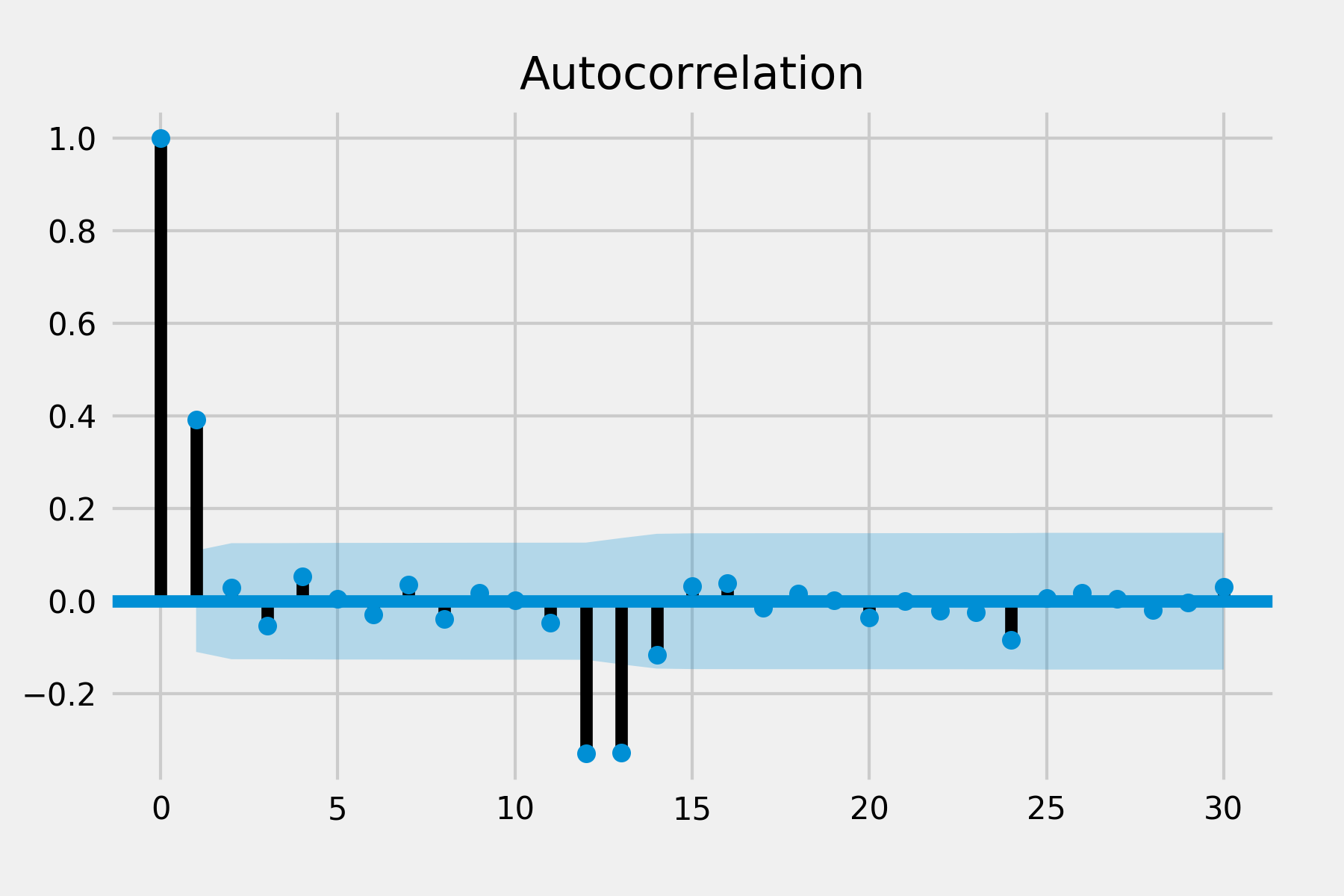

ACF and PACF

plot_acf(diff, lags=30)

plot_pacf(diff, lags=30)

plt.show()

| AR(q) Model | MA(p) Model | |

|---|---|---|

| ACF | Slowly decaying | Only first p autocorrelations are non-zero |

| PACF | Only first q autocorrelations are non-zero | Slowly decaying |

There are significant auto correlations at lag 1 and lag 2 in ACF and there are significant spike of partial auto correlation in lag 1, lag 2 and lag 3 in PACF. There is no obvious spike in other lags so the seasonal pattern may not exist. This suggests that we might use the non-seasonal AR order of 2 and MA order of 3.

Other situation: If all autocorrelations are non-significant, then the series is random. If you have taken first differences and all autocorrelations are non-significant, then the series is called a random walk (Brownian motion) and you are done.

Fitting an ARIMA model

mod = sm.tsa.statespace.SARIMAX(data.set_index('month'),

order=(3, 1, 2),

seasonal_order=(0, 1, 0, 12),

enforce_stationarity=False,

enforce_invertibility=False)

results = mod.fit()

print(results.summary().tables[1])

print("AIC:", results.aic)

The output

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

ar.L1 -1.6732 0.051 -32.838 0.000 -1.773 -1.573

ar.L2 -1.5997 0.060 -26.699 0.000 -1.717 -1.482

ar.L3 -0.5174 0.052 -10.015 0.000 -0.619 -0.416

ma.L1 1.1300 0.032 34.951 0.000 1.067 1.193

ma.L2 0.9943 0.053 18.724 0.000 0.890 1.098

sigma2 4.56e+05 4.19e+04 10.887 0.000 3.74e+05 5.38e+05

==============================================================================

AIC: 4802.58755366782

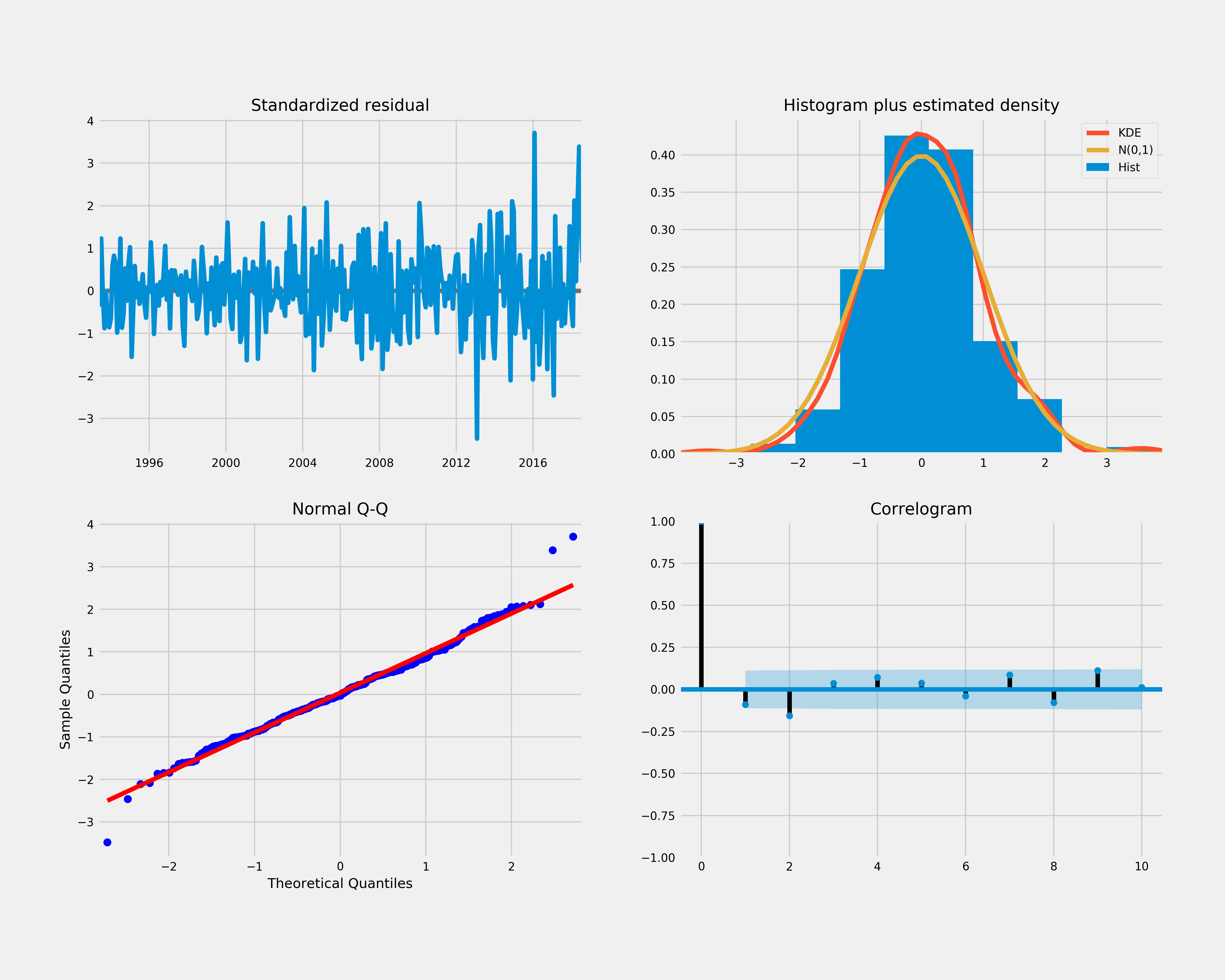

Evaluate and diagnose a possible model

results.plot_diagnostics(figsize=(15, 12))

plt.show()

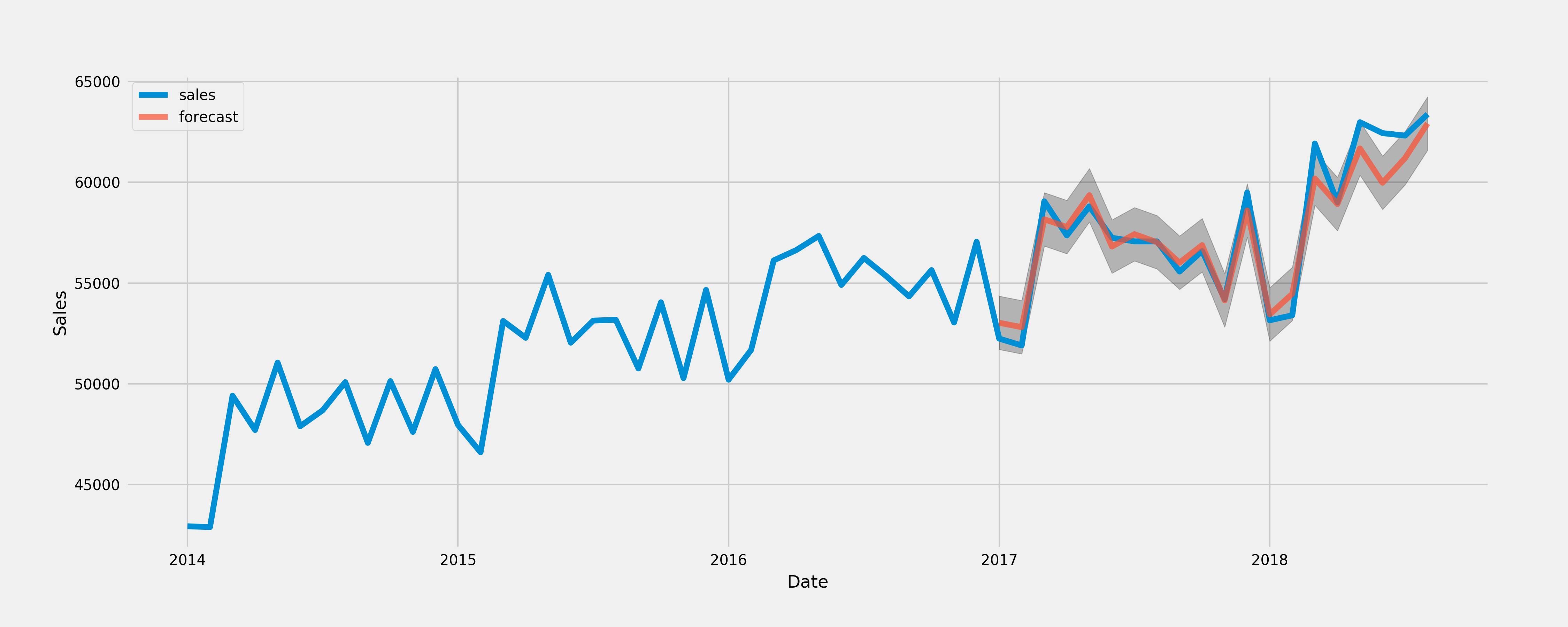

pred = results.get_prediction(start=pd.to_datetime('2017-01-01'), dynamic=False)

pred_ci = pred.conf_int()

ax = data.set_index('month')['2014':].plot(label='observed', figsize=(20, 15))

pred.predicted_mean.plot(ax=ax, label='forecast', alpha=.7)

ax.fill_between(pred_ci.index,

pred_ci.iloc[:, 0],

pred_ci.iloc[:, 1], color='k', alpha=.25)

ax.set_xlabel('Date')

ax.set_ylabel('Sales')

plt.legend()

plt.show()

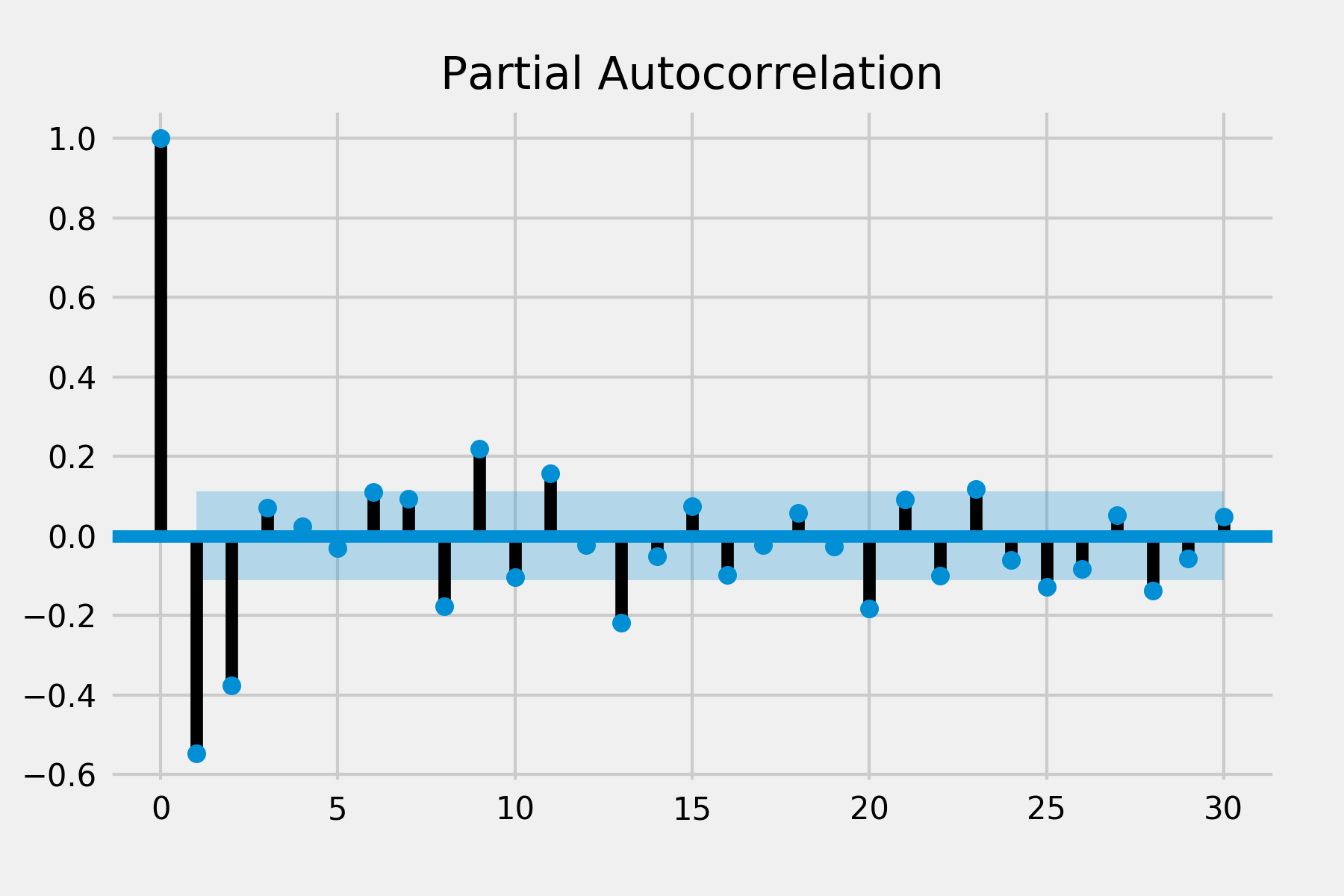

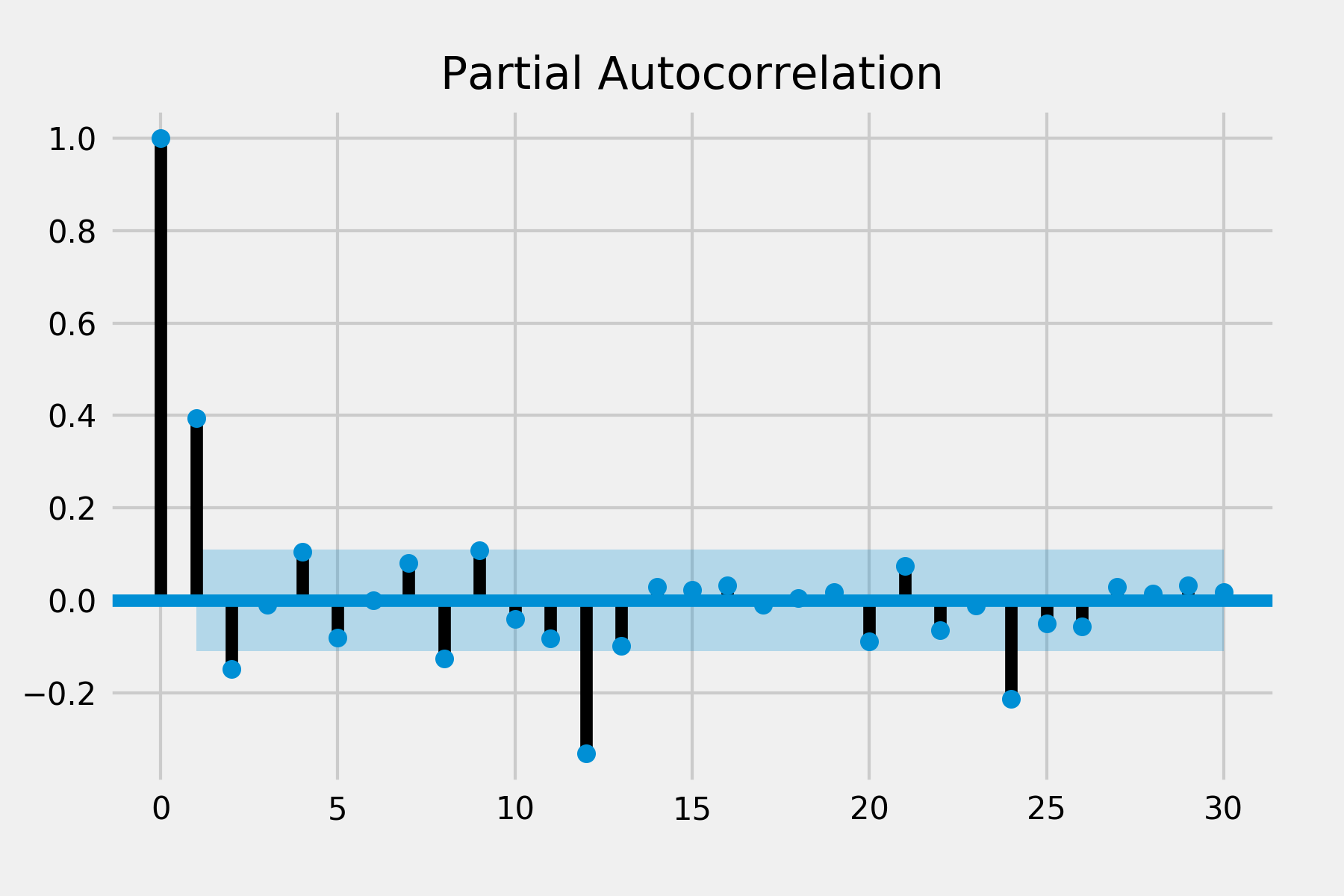

plot_acf(results.resid, lags=30)

plot_pacf(results.resid, lags=30)

plt.show()

- Look at the significance of the coefficients (the table above). All p values of coefficients are 0 that means they are significantly different from 0

- Look at QQ plot (bottom left) and KDE line (top right). It shows the normality of residuals

- Look at the residuals over time plot (top left). It does not display any obvious seasonality

- Look at a plot of residuals versus fits and/or a time series plot of the residuals for constant/non-constant variance

- Look at the ACF of the residuals (bottom right). There are significant spikes at lag 12 and lag 13 in ACF and a spike at lag 12 in PACF so we may try to add seasonal parameters of AR or MA.

The model is not correctly specified, we’ll have to revise our guess by modifying parameters and possibly explain ACF and PACF in a different direction.

mod = sm.tsa.statespace.SARIMAX(data.set_index('month'),

order=(3, 1, 2),

seasonal_order=(1, 1, 0, 12),

enforce_stationarity=False,

enforce_invertibility=False)

results = mod.fit()

print(results.summary().tables[1])

print("AIC:", results.aic)

Output is like

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

ar.L1 -1.6801 0.054 -31.068 0.000 -1.786 -1.574

ar.L2 -1.6082 0.063 -25.421 0.000 -1.732 -1.484

ar.L3 -0.5238 0.055 -9.606 0.000 -0.631 -0.417

ma.L1 1.1334 0.027 42.356 0.000 1.081 1.186

ma.L2 0.9920 0.042 23.828 0.000 0.910 1.074

ar.S.L12 -0.2928 0.064 -4.579 0.000 -0.418 -0.167

sigma2 4.56e+05 4.71e-08 9.68e+12 0.000 4.56e+05 4.56e+05

==============================================================================

print("AIC:", results.aic)

AIC score is lower. p values show coefficients are significantly different from 0.

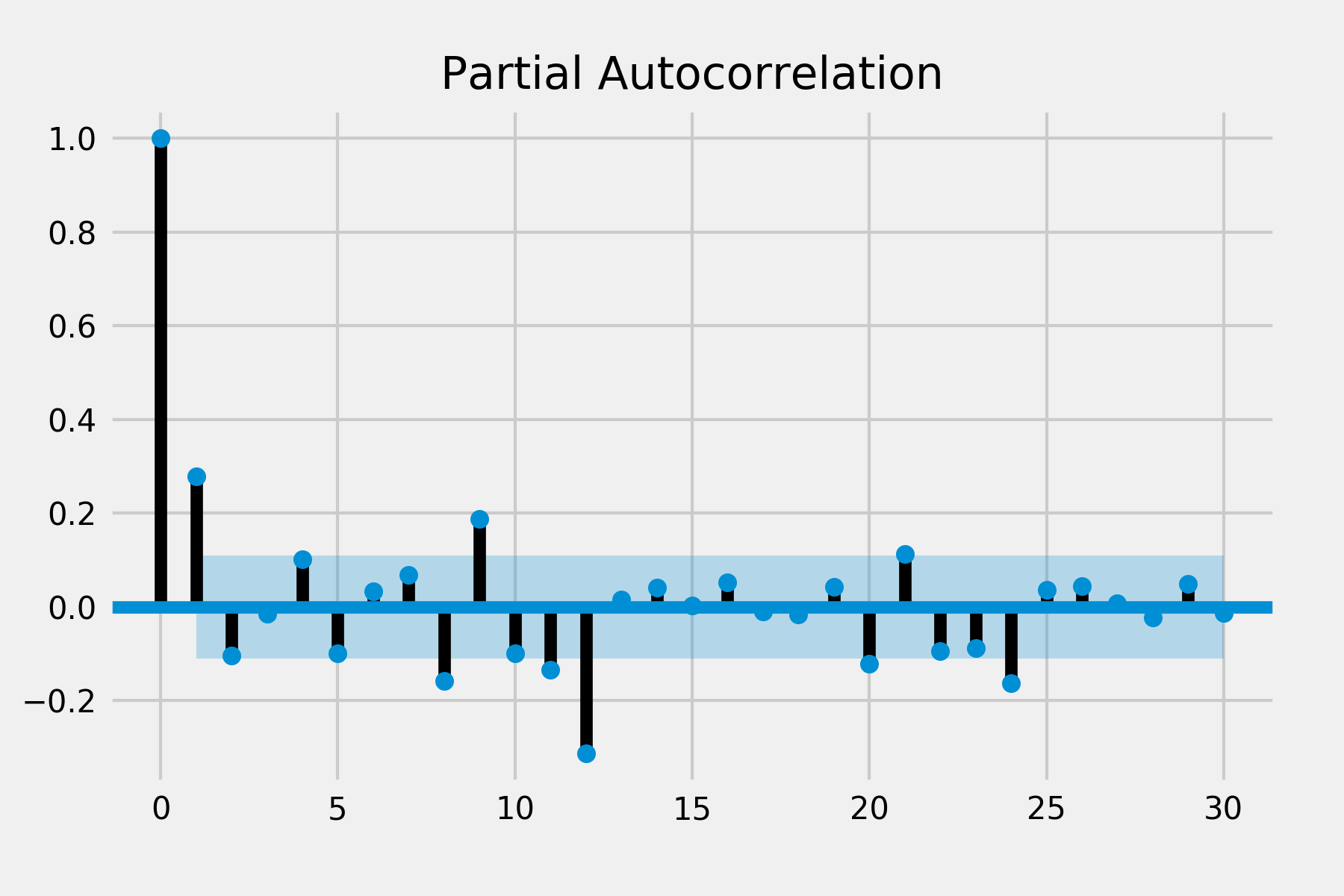

plot_acf(results.resid, lags=30)

plot_pacf(results.resid, lags=30)

plt.show()

PACF looks good but there are still two spikes in ACF. Because it is also difficult to infer p and q from the ACF and PACF, I’ve tried different combinations of seasonal orders. The previous one still provides a better result and reasonable parameters to interpret.

Validate the model

pred = results.get_prediction(start=pd.to_datetime('2017-01-01'), dynamic=False)

pred_ci = pred.conf_int()

ax = data.set_index('month')['2014':].plot(label='observed', figsize=(20, 15))

pred.predicted_mean.plot(ax=ax, label='forecast', alpha=.7)

ax.fill_between(pred_ci.index,

pred_ci.iloc[:, 0],

pred_ci.iloc[:, 1], color='k', alpha=.25)

ax.set_xlabel('Date')

ax.set_ylabel('Sales')

plt.legend()

plt.show()

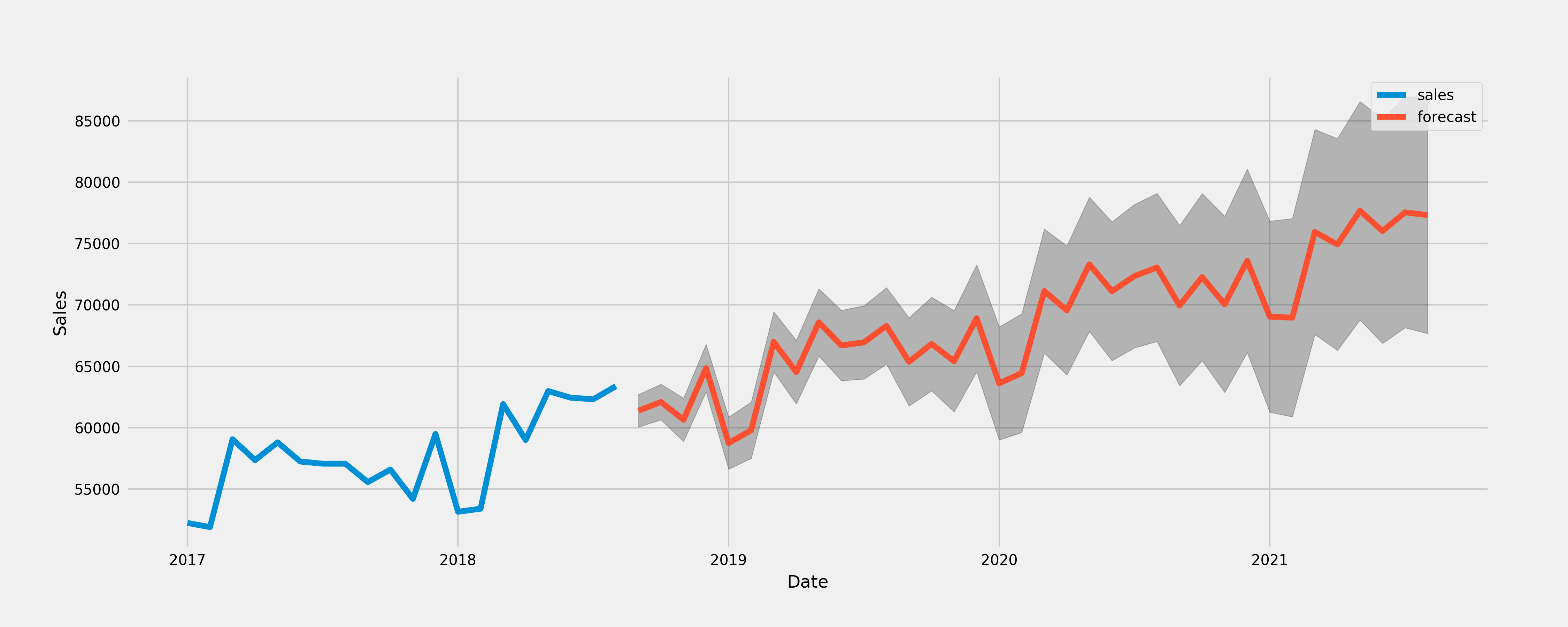

Make forecasting

pred_uc = results.get_forecast(steps=36)

pred_ci = pred_uc.conf_int()

ax = data.set_index('month')['2017':].plot(label='observed', figsize=(20, 15))

pred_uc.predicted_mean.plot(ax=ax, label='forecast')

ax.fill_between(pred_ci.index,

pred_ci.iloc[:, 0],

pred_ci.iloc[:, 1], color='k', alpha=.25)

ax.set_xlabel('Date')

ax.set_ylabel('Sales')

plt.legend()

plt.show()

Method2 - Automatic parameter selection

Try different combination of parameters (pretty similar to grid search for machine learning process) to find the optimal selection of parameters by checking AIC/BIC score.

Create non-seasonal and seasonal parameters

# non-seasonal order

p = d = q = range(0, 4)

pdq = list(itertools.product(p, d, q))

# seasonal order

p = d = q = range(0, 2)

s = [12]

seasonal_pdq = list(itertools.product(p, d, q, s))

Fit the ARIMA model using different combination of parameters

for param in pdq:

for param_seasonal in seasonal_pdq:

try:

mod = sm.tsa.statespace.SARIMAX(data.set_index('month'),

order=param,

seasonal_order=param_seasonal,

enforce_stationarity=False,

enforce_invertibility=False)

results = mod.fit()

print('ARIMA{}x{}12 - AIC:{}'.format(param, param_seasonal, results.aic))

except:

continue

The outputs is like

ARIMA(0, 0, 0)x(0, 0, 0, 12)12 - AIC:7601.915487380611

ARIMA(0, 0, 0)x(0, 0, 1, 12)12 - AIC:7333.604715990744

ARIMA(0, 0, 0)x(0, 1, 0, 12)12 - AIC:5534.639806455742

ARIMA(0, 0, 0)x(0, 1, 1, 12)12 - AIC:5208.000484472617

ARIMA(0, 0, 0)x(1, 0, 0, 12)12 - AIC:5120.972151463306

ARIMA(0, 0, 0)x(1, 0, 1, 12)12 - AIC:5105.101105479268

ARIMA(0, 0, 0)x(1, 1, 0, 12)12 - AIC:5056.488492581053

ARIMA(0, 0, 0)x(1, 1, 1, 12)12 - AIC:5038.368220316868

ARIMA(0, 0, 1)x(0, 0, 0, 12)12 - AIC:7349.690332433109

ARIMA(0, 0, 1)x(0, 0, 1, 12)12 - AIC:12485.014390547416

ARIMA(0, 0, 1)x(0, 1, 0, 12)12 - AIC:5304.233349330357

...

Find the parameters that has the lowest AIC. Then evaluate and diagnose the model following the final step of method1.

Select the better model

If there are multiple models that are possibly a good fit, we can choose the multiple considering other factors.

- Possibly choose the model with the fewest parameters.

- Examine the estimate of the variance. Pick the model with the generally lowest standard errors for predictions of the future.

- Compare models with regard to statistics such as the MSE (the estimate of the variance of the wt), AIC, AICc, and SIC (also called BIC). Lower values of these statistics are desirable.

Other things to consider

If there is a changing, possibly volatile variance, consider using ARCH (autoregressive conditionally heteroscedastic)/GARCH (generalized autoregressive conditional heteroskedasticity).

If the time series is multivariate, VAR (Vector autoregressive) and ARIMAX (Autoregressive Integrated Moving Average with ExplanatoryVariable) model could be the choice.